Starting a small business requires careful planning, and a crucial first step is understanding how to properly register and legalize your venture. This comprehensive guide will walk you through the essential steps of business registration, ensuring your company is compliant with all relevant legal requirements. We’ll cover everything from choosing the right business structure (sole proprietorship, LLC, partnership, etc.) to obtaining the necessary licenses and permits, protecting your intellectual property, and understanding your tax obligations. Learn how to establish a solid legal foundation for your small business and avoid costly mistakes down the line. Registering your business is a significant step towards success, and we’re here to make the process as smooth and straightforward as possible.

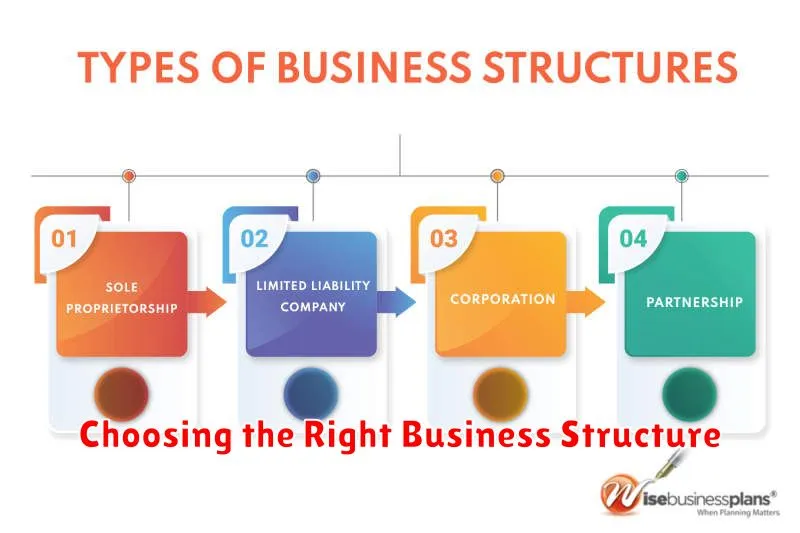

Choosing the Right Business Structure

Selecting the appropriate business structure is a crucial step in legalizing your small business. The structure you choose significantly impacts your liability, tax obligations, and administrative requirements.

Common structures include sole proprietorships (simple to set up, but offers no liability protection), partnerships (shared responsibility and liability), limited liability companies (LLCs) (combining benefits of partnerships and corporations with limited liability), and corporations (S-corps and C-corps) (more complex, offering strong liability protection but involving more paperwork and regulations).

The best structure depends on several factors, including the size and nature of your business, your personal liability tolerance, and your tax planning goals. Consulting with a legal or financial professional is highly recommended to determine the most suitable structure for your specific circumstances.

Careful consideration of these factors at the outset will help ensure your business operates within the law and is positioned for sustainable growth. Choosing the wrong structure can lead to significant financial and legal complications down the line.

Registering Your Business Name Legally

Registering your business name legally is a crucial first step in establishing your small business. This process, often involving a trademark search and registration, protects your brand identity and prevents others from using a similar name.

The specific requirements vary by location. In many jurisdictions, this involves registering a fictitious business name (also known as a DBA or “doing business as”) if your business operates under a name different from your own. You may also need to register for a state-level trademark, depending on your business structure and ambitions. A federal trademark offers broader protection, but involves a more complex and costly application process.

Before registering, conduct thorough research to ensure your chosen name is available and doesn’t infringe on existing trademarks. Consult with a legal professional or utilize online resources provided by your state or federal government to navigate the specific regulations and requirements in your area.

Proper registration secures your business’s identity, allowing you to open bank accounts, secure business licenses, and confidently operate without fear of legal challenges from similar businesses.

Obtaining the Necessary Licenses and Permits

Securing the appropriate licenses and permits is crucial for operating a legal and compliant small business. The specific requirements vary significantly depending on your business type, location, and industry. It’s essential to research the regulations at both the federal, state, and local levels.

Start by identifying the necessary licenses. Common examples include a business license (often required at the city or county level), professional licenses (if applicable to your profession), and industry-specific permits (such as those for food handling, construction, or alcohol sales). You may need to register with the Internal Revenue Service (IRS) for a tax identification number (EIN) as well.

To streamline the process, consult your state’s Small Business Administration (SBA) website or local government resources. These websites often provide comprehensive lists of required licenses and permits, application forms, and contact information for relevant agencies. Failing to obtain the necessary licenses and permits can result in significant fines and legal repercussions, so thorough research and timely application are vital.

Setting Up a Business Bank Account

Opening a separate business bank account is a crucial step in legalizing your small business. This keeps your personal and business finances completely separate, which is vital for tax purposes and liability protection.

To open a business account, you’ll typically need documentation such as your business registration documents (articles of incorporation, LLC operating agreement, etc.), your personal identification, and an EIN (Employer Identification Number) or SSN (Social Security Number), depending on your business structure. Some banks may also require a business plan or financial statements.

Shop around and compare different banks and credit unions to find the best option for your business. Consider factors such as fees, interest rates (if applicable), and available services (online banking, mobile app, etc.).

Maintaining a well-organized business bank account demonstrates financial responsibility and strengthens your business’s credibility. It simplifies accounting, makes tax preparation easier, and helps you effectively manage your company’s financial health.

Understanding Tax Obligations for Small Business

Registering your small business involves understanding your tax obligations. These vary significantly depending on your business structure (sole proprietorship, partnership, LLC, corporation), location, and industry.

Key taxes you’ll likely encounter include federal income tax (paid through estimated taxes or quarterly payments), state income tax (if applicable), and self-employment tax (for sole proprietors and partners). You may also face sales tax, depending on your state and the goods or services you offer.

Accurate record-keeping is crucial. Maintain detailed financial records, including income and expenses, to accurately calculate and file your taxes. Consider using accounting software to simplify this process.

Seek professional advice. Consulting with a tax professional or accountant is highly recommended. They can help you understand your specific tax liabilities, choose the best tax structure for your business, and ensure compliance with all applicable regulations.

Failure to comply with tax obligations can result in significant penalties and interest charges. Proactive tax planning is essential for the long-term success and stability of your small business.

Protecting Your Business with Trademarks and IP

Protecting your intellectual property (IP) is crucial for a small business’s success and longevity. This involves securing trademarks for your brand name, logo, and other unique identifiers. A trademark prevents others from using similar branding, safeguarding your reputation and market position.

Beyond trademarks, consider other forms of IP protection. Copyrights safeguard your original creative works, such as website content, marketing materials, and software. Patents protect your inventions, offering exclusive rights to manufacture, use, and sell your innovations. Understanding which type of IP protection is best suited for your business is critical.

The process of registering your IP varies depending on the type of protection and your location. Generally, you’ll need to file an application with the relevant government agency (e.g., the USPTO in the US). It is advisable to seek legal counsel from an intellectual property lawyer to navigate this process effectively and ensure your IP is properly protected. This professional guidance can prevent costly mistakes and secure the strongest possible protection for your business’s unique assets.

Hiring Employees Legally and Ethically

Hiring employees legally and ethically is crucial for your small business’s success and to avoid potential legal issues. Compliance with federal and state labor laws is paramount. This includes obtaining necessary licenses and permits, accurately classifying employees (versus independent contractors), and understanding wage and hour regulations, including minimum wage, overtime pay, and breaks.

Before hiring, establish clear job descriptions outlining responsibilities and qualifications. Use a fair and non-discriminatory hiring process, avoiding questions about protected characteristics. Conduct thorough background checks, where legally permissible, to ensure a safe workplace. Provide new hires with a comprehensive employee handbook outlining company policies, procedures, and employee rights.

Maintain accurate payroll records and ensure timely payment of wages and taxes. Comply with regulations regarding employee benefits, such as workers’ compensation insurance and, if applicable, health insurance. Foster a positive and respectful workplace culture that values diversity, equity, and inclusion. Regularly review and update your employment practices to ensure ongoing compliance with evolving laws and best practices.

Consider consulting with an employment lawyer or HR professional to ensure your hiring practices align with all applicable laws and regulations. Proactive measures to understand and comply with labor laws will safeguard your business from potential liabilities and contribute to a positive work environment.

Tips for Staying Compliant with Local Laws

Understanding and adhering to local laws is crucial for the success and longevity of your small business. Failure to comply can result in significant fines, legal battles, and even business closure.

Begin by identifying all relevant local, county, and city regulations impacting your business type and location. This includes zoning laws, permits, licenses, and tax requirements. Consult your city or county’s website for comprehensive information.

Obtain all necessary permits and licenses promptly. This often involves applications, fees, and inspections. Keep meticulous records of all documentation related to licensing and permits.

Stay updated on changes to local laws and regulations. Subscribe to relevant newsletters, attend local business meetings, or consult with legal professionals to ensure ongoing compliance. Regular reviews of your business practices are essential to prevent violations.

Properly handle tax obligations. This includes understanding sales tax, property tax, and other applicable taxes. Maintain accurate financial records and file tax returns on time to avoid penalties.

Finally, consider consulting with a legal professional specializing in small business law. They can provide personalized guidance to navigate complex regulations and ensure your business remains compliant.